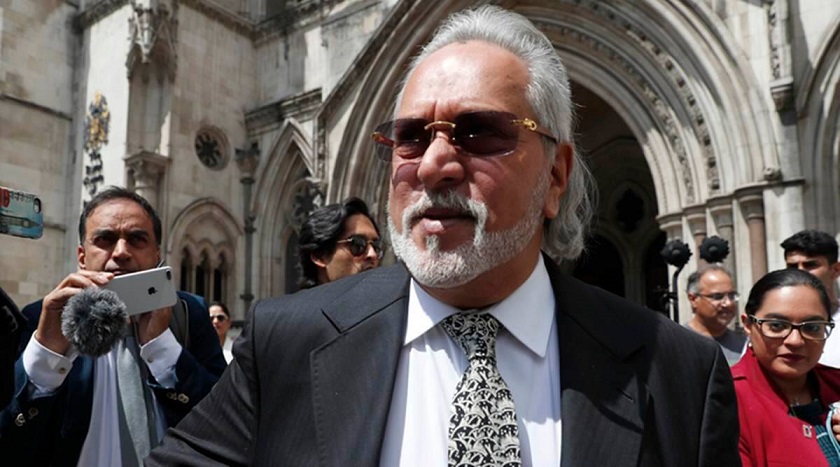

A special court in two separate orders passed recently has allowed restoration of properties of businessman Vijay Mallya and companies linked to him to a consortium of banks, led by State Bank of India, to recover the due loan amount of over Rs 5,600 crore.

Special Judge J C Jagdale said the claimants of the properties are public sector banks and that they have suffered a “quantifiable loss”. The court also said Mallya had himself proposed replacement of the amount due on him, while now he is opposing the plea for restoration to recover the losses made by the banks. “…it is material to note that the claimants are public sector banks and these banks are dealing with public money. There cannot be any personal or private interest of said claimants to pursue such a claim against the present respondents (Mallya, Kingfisher Airlines and other companies) and accused. Therefore, one can safely conclude that it has been done in good faith,” the court said.

“As far as the ‘quantifiable loss’ is concerned, it is apparent that the claimants have suffered losses… The claim of the applicant banks of Rs 6203,35,03,879.42 is not imaginary,” the court added, allowing properties valued at over Rs 5,600 crore to be restored for recovery.

Among the immovable properties are under construction flats in Kingfisher Tower in Bengaluru, property in UB City, and an apartment in Grant Road in Mumbai, among others.

After a case was registered by the Enforcement Directorate against Mallya and other companies concerned, the properties linked to them were provisionally attached. The consortium of banks, which had granted loans to them, had sought recovery of Rs 5,600 crore by approaching the Debt Recovery Tribunal (DRT) in Bengaluru.

In 2017, their claims were allowed by the DRT, which had directed the banks to be paid the claim amount with 11.5 percent interest. The appeals filed by the companies were rejected in various forums. The banks approached the special court, seeking release of the attached properties so that the recovery officer can proceed with further proceedings.

Mallya and his companies opposed the plea, stating that the properties were acquired many years ago and were not proceeds of crime. It was also claimed that the plea was not maintainable as the appeals filed against their attachment by the ED were pending. The companies also said the plea by the banks was premature and that the loan obtained from them for Kingfisher Airlines was for “completely legitimate purposes”.

The court said this showed prima facie “falsification of accounts and misappropriation of funds” and added that this was not the stage to decide the criminal liability of the accused.

“Even the accused Dr Vijay Mallya himself placed a proposal for replacement of the due amount. Had there really been no loss to the applicant banks, then why Dr Vijay Mallya is ready to repay the loss?” the court asked on May 24.

It also said other third party claimants will have to approach the DRT. The court directed the recovery officer through whom the restoration will take place and the banks to submit a bond of undertaking, in compliance of the Certificate of Recovery issued by the DRT in 2017. The properties are included in schedules submitted by the ED, which had given its no-objection to the banks’ plea.

More Stories

How Japan Airlines crew led 367 passengers to safety from a burning plane

Rishi Sunak declares success in meeting UK’s asylum target

Electroplus Ltd Sponsors the Truth Story Newspaper News